Power Semiconductor s Q3 losses narrow, WoW mass production schedule next year attracts attention

Power Semiconductor's third-quarter financial report showed that its single-quarter net loss narrowed compared with the previous quarter, but it was still the ninth consecutive quarter of losses, and the first three quarters were also losses. The narrowing of losses was mainly due to the impact of the reversal of price decline losses and the reduction of foreign exchange losses. The single-quarter utilization rate was about 78%, and the overall profit has not yet returned to a positive number.

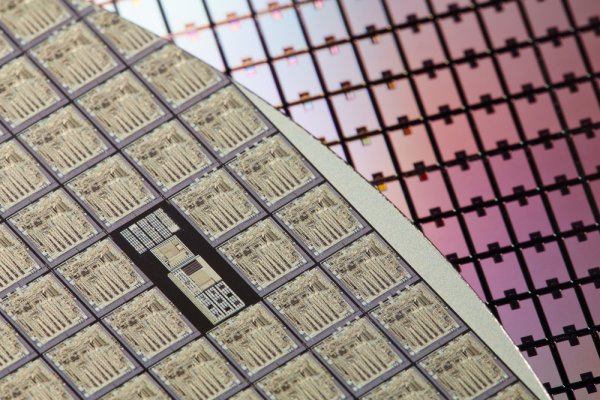

In terms of product mix, Power Semiconductor's memory shipments increased in the third quarter, the revenue contribution of DRAM and NAND increased, and the proportion of memory increased significantly. HBM (High Bandwidth Memory) demand continued to grow, and Korean manufacturers reduced production and led to the recovery of SLC NAND. The increase in the overall average selling price of memory has begun to be reflected in OEM shipments.

In terms of capital expenditure, Power Semiconductor has revised down its 2025 capital expenditure from the original contract of US$454 million to US$341 million, and postponed some investment schedules to the following year. As a foundry, there is a time lag in the reflection of rising product prices on foundry fees. The deferred effect of price increases will be gradually seen starting in November.

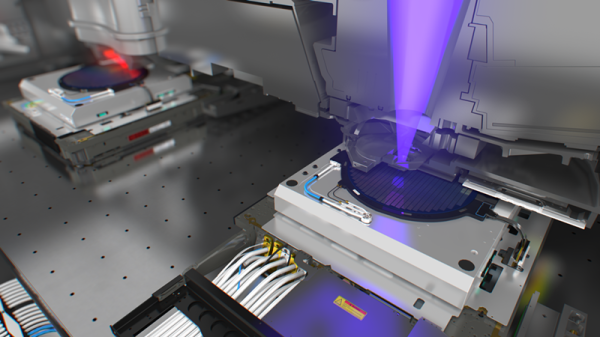

With advanced packaging layout, Power Semiconductor's 2.5D packaging with silicon interposer as the core has reached mass production yield and will be expanded into production; 3D wafer stacking (Wafer-on-Wafer, WoW) is currently entering the proof-of-concept stage. If the verification goes smoothly, the mass production schedule is expected to fall in the second half of 2026.

In terms of revenue momentum, recent monthly revenue has remained in the high-end range in recent years, and has shown annual growth for several consecutive months. Against the background of rising memory wafer production and prices, there is a chance that the wafer production volume and foundry prices will rise simultaneously in the fourth quarter.