Agree to NVIDIA to export H20 chips to China, the market believes that Trump s semiconductor tax responsibilities will be softened

Semiconductor industry is neurosensitized, and US President Trump's remarks have once again caused trouble. He said a few days ago that new semiconductor taxes may be implemented soon. In this regard, Bloomberg's report pointed out that Trump mentioned that he is likely to be taxed on semiconductors and drugs before August 1st. This potential trade policy adjustment undoubtedly casts a shadow on the global chip supply chain.

However, market analysts hold different views on this. Foreign securities Wedbush pointed out in its latest research report that it is believed that the Trump administration will continue to soften its tax-related position. The reason is that Trump will seek to reach trade agreements with countries including China, Japan and India, which will not significantly change the current situation of technology manufacturers. Even after Trump's latest statement on semiconductor tax responsibilities, Wedbush's report continued to maintain a sense of discontinuity. This means that despite the sound of tax threats, there is still some view in the market that actual policy implementation may be more cautious to avoid causing a dramatic impact on the existing industry landscape.

According to foreign media reports, in the context of tax threats and policy uncertainties, the US government's attitude towards specific technology companies has become the focus of market attention. One of the things that Wedbush sees as a positive development in the technology field is the latest trend of NVIDIA (Nvidia). Because NVIDIA has recently announced that it has obtained permission from the US government to resume selling its H20 artificial intelligence (AI) chips to China. This should be read as a signal that the Trump administration has changed the ban previously imposed to limit China's AI ambitions, which leads to possible policy back-ups. Previously, the US government imposed strict restrictions on the export of advanced AI chips in China, aiming to weaken China's development capabilities in the AI field.

However, NVIDIA's current exports to the Chinese market are considered an important and important development in the overall science and technology field. This not only provides new momentum for NVIDIA's acquisition in the Chinese market, but may also indicate that in the future, China and the United States may still have a practical cooperation space even if faced with political pressure. This news also solved the market's concern about the comprehensive technology "destroyment" to a certain extent.

Although the news from NVIDIA has brought a wave of dawn, the latest statement from semiconductor equipment maker ASML has cast a new shadow on the market. ASML's share price fell sharply by more than 8% last Wednesday after its second-quarter financial report, as it could not guarantee 2026 harvest growth amid current macroeconomic and geopolitical inaccuracies.

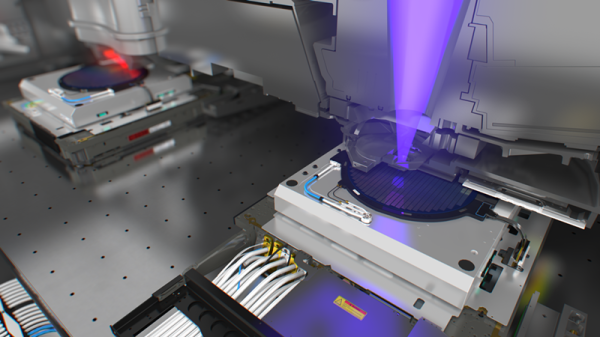

The reason why ASML's statement has attracted widespread attention is that ASML is at the core of global semiconductor supply chains. ASML equipment sales include US chip maker Intel, and TECHNOLOG, the world's largest contract chip maker. This means that any inconsistency in ASML may have a profound impact on the world's leading chip manufacturers and their customers. ASML's statement that it cannot guarantee future growth reflects factors such as uncertain global economic outlook and rising geopolitical risks, which is a potential impact on semiconductor industry capital expenditure and future production expansion.

Since the decline in ASML stock prices, the stock prices of other major semiconductor companies were also affected. Shares in Intel and memory maker Micron Technology also fell at the same time. This highlights the high degree of interoperability of semiconductor industries. A challenge from a key supplier is often quickly transmitted to the entire industry link, causing more extensive market fluctuations.

In summary, global semiconductor industries are at a critical crossroads. On the one hand, potential tax threats from the political level and actual policies (such as NVIDIA's approval to resume sales in China) indicate that future trade policies may be in a dilemma between toughness and practicality. On the other hand, the conservative expectations of major equipment suppliers for future growth prospects reveal the material pressures brought by macroeconomic and geopolitical factors on the fundamentals of the industry.