Ten years of memory shortage? Demand for AI servers explodes, from HBM to SSD.

With the surge in demand for high-bandwidth memory (HBM) and server memory modules (RDIMM) in data centers, major computer manufacturers such as Asus and MSI are facing a memory shortage crisis. According to DigiTimes, these companies are rushing to purchase memory from the spot market to cope with the increasingly tight supply situation. Although Asus says it has enough memory stocks for production use to last until the end of the year, if the situation does not improve, it is expected to feel the pressure of shortages by 2026 and may need to adjust prices.

Usually, large companies sign contracts with memory manufacturers, but currently they are also purchasing large quantities on the spot market. This change shows the tightness of the market. Prices in the spot market are highly volatile, causing retail customers to also feel the pressure of rising prices. Recently, memory prices have increased by more than 100%. Some Japanese stores have even limited the purchase quantity of each customer due to insufficient supply, and some products are already out of stock at distributors.

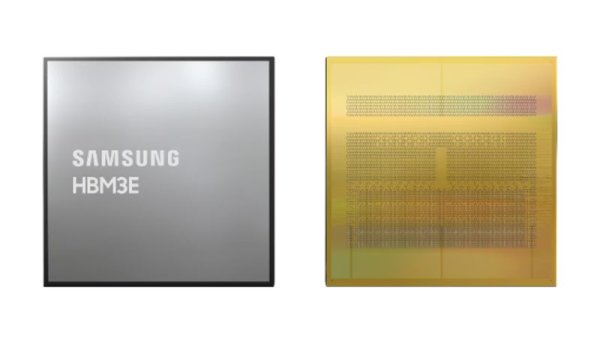

The main reason for this wave of memory shortage is the strong demand in the AI inference (Inference) stage. The amount of data access far exceeds the AI training stage, driving a simultaneous surge in demand for cold data and warm data. AI servers need to process terabytes of data during the inference phase, which cannot be carried by DRAM or HBM alone. Therefore, high-capacity HDDs and SSDs are also experiencing supply shortages at the same time.

Major memory manufacturers such as SanDisk (Western Digital), Samsung Electronics, SK Hynix, etc. have confirmed that the market supply and demand are imbalanced. SanDisk CEO David Goeckeler predicts that data center NAND demand will exceed the mobile field for the first time in 2026, and the trend of short supply will continue until the end of next year. SK Hynix also revealed that its NAND production capacity in 2026 has been "all sold out" and some suppliers are seeking long-term contracts.

Analysts estimate that the DRAM usage of AI servers is about 8 times that of traditional servers, and the NAND usage is about 3 times. In 2025, AI applications will account for a significant proportion of global memory demand. Since the fourth quarter of this year, DRAM contract prices are expected to rise by 10-30%, NAND flash memory prices have climbed by 5-10%, and high-capacity hard drive delivery times have been extended to more than 52 weeks.

Cloud service providers (such as Pure Storage) purchase NAND in large quantities for AI data centers, and some hyperscale players have manufactured their own SSDs to control the supply chain. Small players face longer delivery times and higher costs due to lack of bargaining power. Smartphone manufacturers such as Xiaomi have warned that soaring memory costs may lead to higher phone prices.

Gou Jiazhang, general manager of Huirong Technology, expects that the structural growth driven by AI inference will keep the storage supply chain tense for a long time, and the shortage will continue until 2026, and may even be extended to 2027. Some experts believe that if the situation remains unchanged, this price storm may last for ten years.

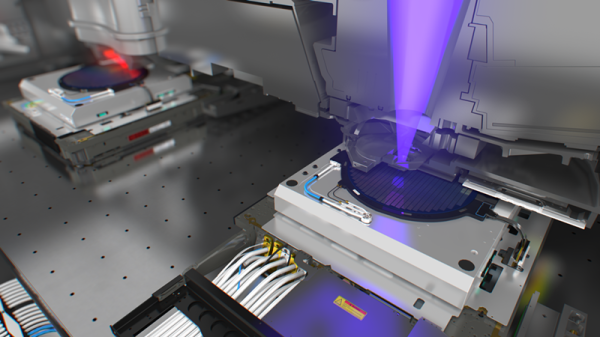

Most memory manufacturers reported record profits in Q3 this year, but due to high market volatility, they are cautious about investing billions of dollars in expanding wafer fabs. Even if new factories are built now, it will still take months or even years to release production capacity, making it difficult to alleviate the shortage in the short term.

Asus, MSI, other manufacturers panic-buying RAM stocks, while major memory chipmakers rake in profits — massive demand for HBM and RDIMM for data centers driving shortage Further reading: Memory prices are in chaos! The launch of new module factory products has been postponed from Q4 this year to 2026