Samsung warns: What is the reason for the decline in HBM market price?

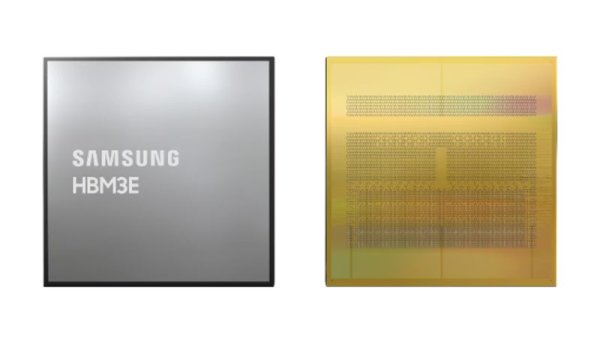

South Korea's Samsung Electronics recently released a market warning, implying that its latest generation of high-frequency wide memory (HBM), that is, the price of HBM3E products may face a decline in pressure. Samsung said that the current market supply growth rate is expected to exceed demand growth trends, resulting in changes in supply and demand relations. Market analysis also pointed out that in addition to the overall market supply and demand change, Samsung itself adopts an important price strategy to promote HBM3E's 12-layer stacking products to major customers, and is also regarded as an important factor affecting the market price trend.

According to ZDnet Korea's report, Samsung's public statement at its recent second quarter financial conference, the company clearly stated that for HBM3E products, the expected supply and demand relationship will change as the supply growth rate is expected to exceed demand growth. Samsung further predicts that this change will have an impact on market prices over the foreseeable future. This statement not only reveals views on the future price trends of HBM3E, but also explores its potential impact on the company's overall profit structure.

In addition, Samsung also commented that considering the traditional DRAM price is expected to show an upward trend in the second half of the year, the profit gap between HBM3E and traditional DRAM may narrow rapidly. This represents the unique high interest advantage of HBM3E as a new generation of high-level memory, which may face challenges due to changes in market supply and demand.

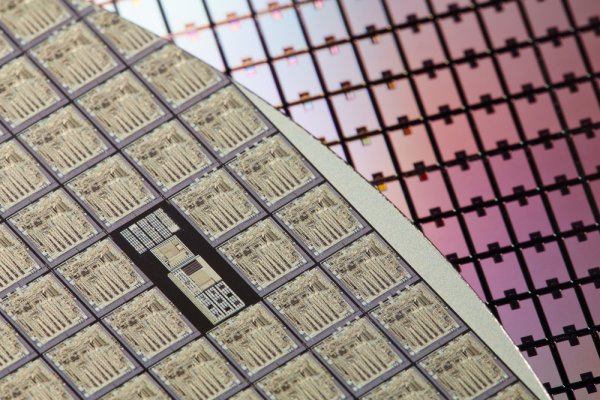

In fact, HBM3E adopts the most advanced fifth-generation high-frequency wide memory technology. According to the number of DRAM stacking layers in this case, HBM3E can be divided into two main types: 8-layer and 12-layer. In the context of the world's leading technology manufacturers, such as NVIDIA (Nvidia) and Ultramicro (AMD) launching the latest artificial intelligence (AI) chips, the market demand for HBM3E's 12-layer stacking product memory is expected to continue to grow significantly in 2025. This shows that HBM3E plays an indispensable role in driving high-performance AI computing, especially the market supply is in short supply due to its higher frequency width and capacity.

However, despite the strong market demand for HBM3E 12-layer stacking products, Samsung is still concerned about the possibility that HBM3E may have oversupply and emphasizes the need to develop profit-optimized operational strategies to address them. It is generally believed in the industry that Samsung's performance not only reflects its cautious evaluation of the market, but also considers the fact that major competitors such as SK Hynix and Micron are actively producing HBM3E 12-layer stacking products. This shows that the HBM3E market is gradually moving towards a competitive and hot-up stage, with major suppliers actively expanding their production capacity to compete for market share.

Marketing personnel analyzed that Samsung's current offensive HBM3E marketing strategy will also have a significant impact on the market. Among them, Samsung Electronics has delayed the productization progress of NVIDIA's HBM3E 12-layer stacking products, and Samsung has proposed a variety of cooperation plans to NVIDIA including price reduction. These actions represent Samsung's aggressive approach to further accelerate the market penetration and productization process of its HBM3E 12-layer stacking products through its price strategy.

Reports emphasize that whether Samsung can successfully supply goods to key customers will directly affect the future changes in the HBM market. This sentence highlights the success and failure of Samsung's cooperation with major customers, and will also have a profound impact on the pattern and pricing strategy of the entire HBM market. If Samsung can successfully promote the widespread commercialization of HBM3E 12-layer stacking products through its strategy, it may further increase the market competition and prompt the overall price to move towards a more flexible adjustment.

Overall, Samsung Electronics' warning of the possible decline in HBM3E prices is not only based on the judgment of macro-concept supply and demand, but also reflects its aggressive strategy to ensure the successful commercialization of its own products in a fierce market competition. With the growing demand for the AI accelerator sector of HBM3E 12-layer stacking version, the expansion and price competition among suppliers will be more intense.