China s expansion of rare earth export controls will have little short-term impact on TSMC, and long-term risks remain to be seen

China announced in October 2025 that it would expand its rare earth export control list, adding new medium and heavy rare earth elements such as europium, 鈥, erbium, 銩, and ytterbium, and would include some processing equipment and related products containing Chinese-funded components within the scope of control. This move is seen as a strategic measure targeting the global high-end manufacturing chain, especially the semiconductor and new energy industries. As restrictions escalate, market focus quickly turns to TSMC, the leader in wafer foundry, and the outside world is concerned about whether this policy will impact its advanced manufacturing processes.

According to the new regulations, exports will need to review the "end use", which covers the research, development and production of logic chips below 14 nanometers, storage chips above 256 layers, and related equipment used to manufacture, test or develop artificial intelligence with potential military applications. In the future, relevant projects will need to be approved on a case-by-case basis, which is a major challenge for the semiconductor industry.

However, according to Wccftech reports, TSMC’s impact will be limited in the short term. Hou Youqing, senior deputy general manager and deputy co-chief operating officer of TSMC, said that the current rare earth inventory of TSMC and its suppliers is enough to support one to two years, and the short-term risk is not high. Taiwan's Ministry of Economic Affairs also pointed out that Taiwan's rare earth imports mainly come from traders in Europe, the United States and Japan and are not directly dependent on China, so the supply can still remain stable in the near future.

However, if China's export controls last too long, it may push up the cost of raw materials and put pressure on the maintenance and replacement of chip manufacturing equipment.

According to statistics from the International Energy Agency (IEA), China will account for 69% of global rare earth production capacity in 2024, followed by the United States 11%, Myanmar 8%, and Australia about 3%. In the field of refining and separation processes, China controls 92% of production capacity, almost forming a monopoly. Due to the high cost, complex procedures and serious pollution risks of rare earth mining and smelting, China has established a supply system that is difficult to replace by virtue of its advantages in automation and scale.

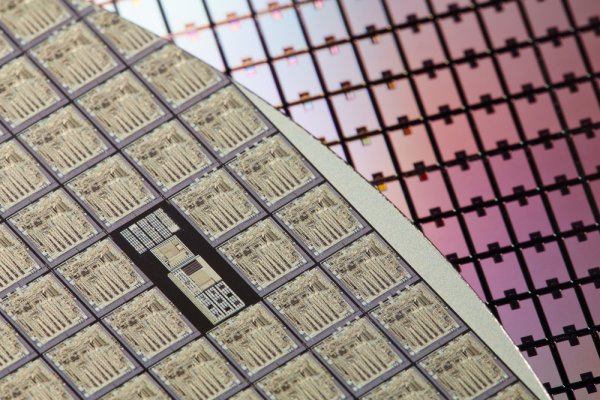

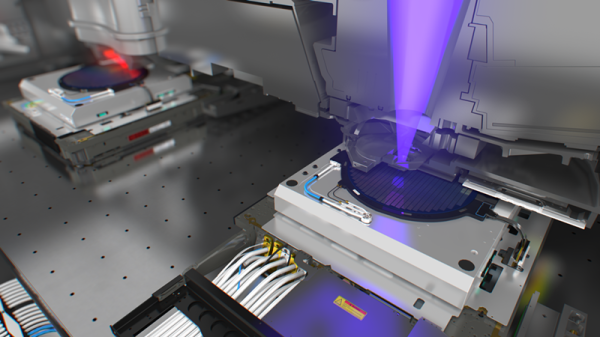

This also means that relatively low-priced rare earths will become more difficult to obtain. Although TSMC itself is limited, the upstream supply chain may be under pressure. Some equipment such as CMP chemical mechanical polishing, EUV masks and precision measurement equipment require the use of small amounts of rare earth materials. If China's control lasts too long, supply bottlenecks may occur in these key components and chemicals, which will indirectly affect the production rhythm of TSMC and its equipment partners such as ASML and Tokyo Electron.

In order to reduce risks, the global semiconductor industry is actively pursuing diversification strategies, including turning to countries such as Australia to develop new supply sources, and promoting rare earth recycling and alternative material technologies. Industries must regularly review inventory cycles and establish secondary and tertiary sources of supply to ensure stable operations despite supply disruptions or policy changes.

TSMC Official Claim ‘Rare Earths’ Supply Chain Is Steady In The Shorter-Term, But Warns About Future Risks If Restrictions Continue